IFRS 17 will change how investors regard insurers

A change is coming that will transform how investors view insurance companies and will revolutionise how insurers manage themselves.

Not quite standard yet

Measurement of profit and loss has been transformed across the globe in the last twenty years by the implementation of IFRS. However, the standard for insurance contracts IFRS 4 didn’t make different insurers’ performance directly comparable for investors.

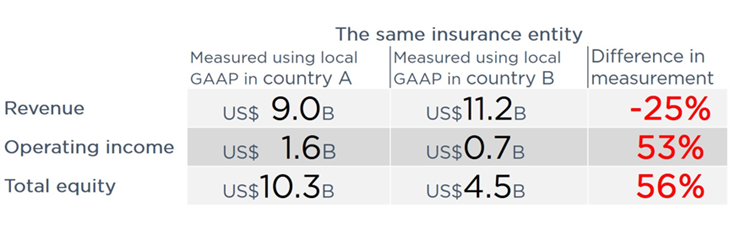

IFRS 4 was considered an interim standard because large differences remain between how profit and loss is measured in different countries. This makes comparison between different insurers difficult. In a recent speech Hans Hoogervorst, Chairman of IASB illustrated the current difference between how one insurance entity is measured in two different countries:

IFRS 17 will make insurers in different countries comparable for the first time

IASB has been working IFRS 17 (previously IFRS 4 Phase II) since 2005. It will become effective in 2022. The principal aim of the standard is to eliminate the kinds of differences seen in the above illustration. In a recent meeting, IASB made a concession to insurers that they would only be required to provide one set of ‘pre IFRS 17’ accounts for 2023. So investors will be left with a total of 2 years’ worth of comparative information to inform the changing nature of insurers’ performance.

This standard will fundamentally change how insurers measure themselves and will require a substantial shift in their business management and back-office operating models. The balance sheets of insurers will radically change and so therefore will investor perception and market valuation of insurers.